Efficacy Analysis: Assessment of policy instruments for renewable energy

Being capital intensive and associated with lower generation levels, renewable energy projects require promotional efforts to make them competitive with conventional energy- based projects. The renewable energy sector in India is being promoted by way of several policy enablers. As a result, there has been a tremendous growth in the deployment of renewable energy based projects across the country. However, with limited public funds and competing demands, a debate has been going on to judge the efficacy of various schemes/incentives in terms of budgetary support and their market impact. An example in this case is the generation based incentive (GBI) scheme and the viability gap funding (VGF) scheme, both of which have their own share of success as well as challenges.

In this regard, an analysis has been undertaken on the aforementioned schemes. With the objective of studying their effectiveness in terms of money utilisation and market development, an analytical comparison has been undertaken on the two most used types of support mechanisms:

- Staggered payment made upon actual generation of clean power (quarterly/ annual mode), like the GBI scheme prevalent in the wind sector.

- Upfront payment to a renewable project, like grants provided to biomass and hydropower projects and the VGF scheme for the solar sector.

For the sake of simplicity, it has been assumed that GBI is being paid to a 1 MW project at the rate of Re 0.50 per kWh for a period of 10 years. The subsidy to be paid on an upfront basis would also be of a similar amount (calculated on a net present value [NPV] basis).

Staggered payment (GBI)

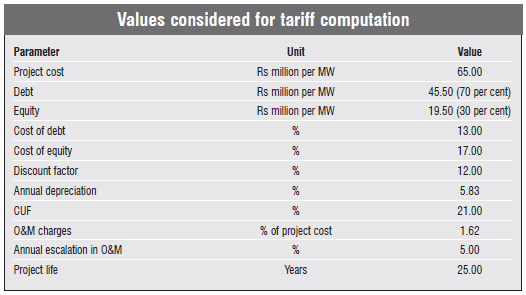

Using the parameters listed in the table, the tariff amounts to Rs 6.18 per kWh. Taking the GBI incentive to be Re 0.50 per kWh for a 1 MW project (generating a plant load factor of 21 per cent and assuming a discount rate of 12 per cent), the total outgo for a 10-year duration on an NPV basis would be Rs 5.2 million.

The incentives would result in an increase of around 8 per cent in the returns to the investor (given a per unit incentive of Re 0.50 on a tariff of Rs 6.18). The impact on the exchequer would also be limited, making it easy to earmark funds for other equally important activities. A 1,000 MW scheme can be rolled out with an allocation of just Rs 920 million in the first year.

Moreover, this mechanism encourages better operations and maintenance (O&M) of the plant as the incentives are related to generation. This was one of the probable reasons for the withdrawal of the accelerated depreciation scheme, which has been subsequently reintroduced.

However, there can be issues related to fund disbursement, as the agency involved in project monitoring and subsidy disbursal upon verifying power generation would be taking a certain percentage of the amount as handling charges. As such, the effective outgo from the government would be higher. The fund handling charges for a 1,000 MW programme would be around Rs 20 million on an annual basis. Further, as wind resources vary from region to region, there could be issues with regard to higher incentives for projects located in better wind regime areas. Even with a defined cap on incentives (both annual and total), higher generation by a project would lead to better realisation (in NPV terms).

Upfront subsidy (VGF)

As elucidated above, the equivalent upfront subsidy for a 1 MW project generating a capacity utilisation factor (CUF) of 21 per cent, availing of GBI (at Re 0.50 per kWh), would be Rs 5.2 million, assuming a discount rate of 12 per cent.

The upfront subsidy (in the form of VGF) can be considered zero-cost equity (promoter contribution) in the project. Considering a project cost of Rs 65 million per MW, the upfront support would reduce it by almost 8 per cent. This would help in reducing the promoter's equity contribution by a staggering 25 per cent (with debt-equity norms of 70:30, the equity would decline from Rs 19.5 million to Rs 14.3 million). This would lead to a multiplier impact, as the spared equity can be ploughed back into setting up more renewable ventures. As such, for every 1 MW project, there can be an additional spin-off capacity of 250 kW (25 per cent).

As the cost of equity is substantially higher than the cost of debt, the other noticeable impact of these zero-cost funds (as a part of promoter equity) would be the lowering of the weighted average cost of capital (WACC). For a project with a debt cost of 13 per cent and an equity cost of 17 per cent, the WACC would be reduced from 14.2 per cent to 12.8 per cent (135 basis point reduction) due to the availability of the upfront subsidy. This would improve the returns on investment for an investor, or contribute towards the reduc¬tion in tariffs. The reduction in the level- lised cost of energy generation on account of upfront subsidy (zero-cost equity) would be around 8 per cent (a Re 0.50 reduction from Rs 6.18 per kWh to Rs 5.69 per kWh). This would make renewable power more attractive/ economical for procurement by utilities.

Moreover, being a one-time payment, the expenses incurred on account of fund disbursal would be substantially lower than those in the previous case.

However, as the subsidy pay-out is on an upfront basis, the project managers may not be motivated to generate optimally throughout the life of the project. This can be partly offset by incorporating appr¬opriate clauses like penalties or deductions from tariff payments (by utilities) in the power purchase agreement in case of underperformance by the project below a certain threshold (calculated annually).

There can also be issues with regard to the apportioning of the budget due to the high amount of fund requirements (the payments of which are to be made on an upfront basis), which may limit the overall size of the programme. A 1,000 MW scheme would require an upfront payment of Rs 5.2 billion (calculated on an NPV basis, in lieu of GBI available for 25 years of project life), compared to an annual outgo of Rs 920 million in the case of GBI. This may be difficult to arrange due to the competing fund requirements of other priority sectors like education, health and agriculture.

Innovative policy design

While upfront payments reduce the cost of capital and free up promoter equity for further investment, staggered payments encourage the promoter to adopt generation optimisation, thereby limiting the strain on the government exchequer.

One possible option that may be explored is a judicious mix of both these mechanisms, so as to facilitate efficient use of scarce budgetary resources. A suggested mechanism can be the part payment as subsidy on an upfront basis and the remaining to be disbursed as GBI, based on actual generation.

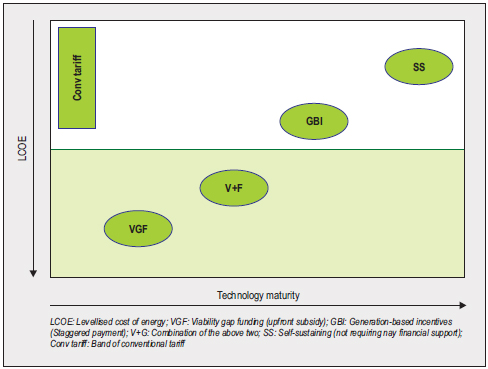

Another mechanism may be designed based on the maturity of a particular renewable technology or segment. The risk premium is inversely proportional to the maturity level of technology. which implies that the lower the maturity, the higher is the risk. This impacts the availability and cost of funds (both equity and debt). For technologies that are at developmental stages, the VGF mechanism can be employed to make the sector attractive for investors (as a part of the equity would be available at zero cost) and to encourage lending by banks for the project at competitive rates. In the case of mature technologies, the GBI mechanism can be followed to ensure higher generation and penetration in the grid.

Another way to increase the impact and efficacy of government support/grants can be the provision of upfront subsidy in the form of low-cost debt (a form of quasi-equity). This would facilitate a reduction in the cost of funds - availability of 10 per cent of project cost (considered to be quasi-equity) at a 5 per cent rate of interest reduces the WACC by around 120 basis points. This can be a revolving fund, which can be ploughed back into the sector for supporting new cleantech ventures, thus creating a kind of virtuous cycle.

The way forward

These innovative mechanisms can be discussed in larger stakeholder forums in order to enable the design and development of appropriate and efficient policies for promoting a particular set of renewable energy technologies, with optimum utilisation of public funds. A support mechanism can be launched on a pilot basis to gauge its efficacy with regard to the utilisation of funds in terms of market development, before rolling it out across the country.